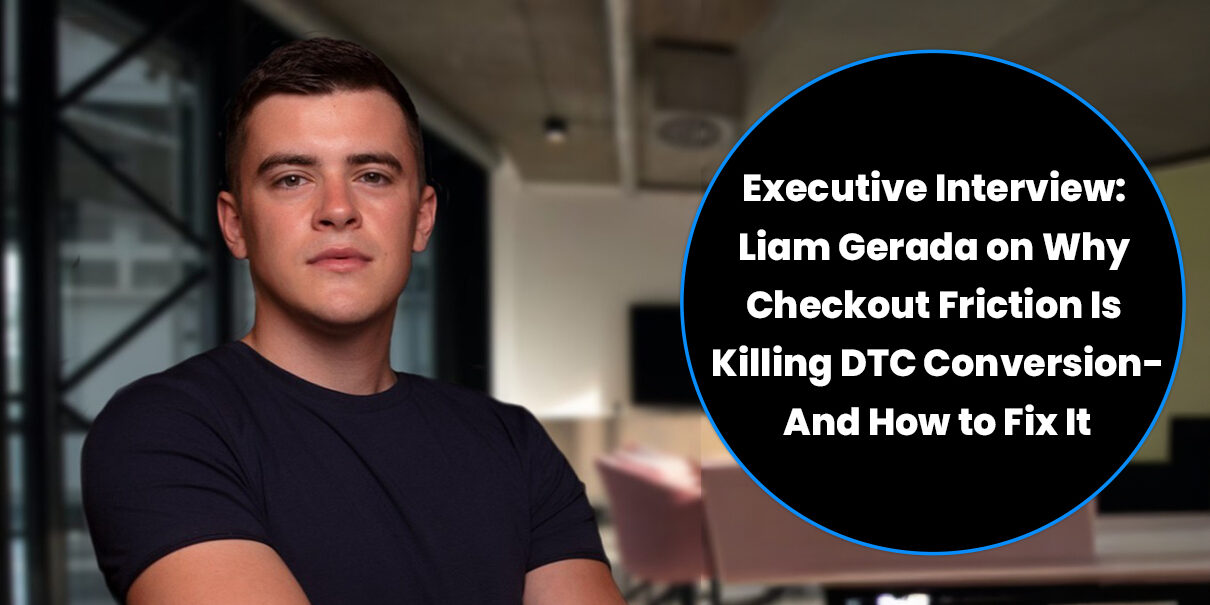

Krepling Pay is the highest-converting ecommerce checkout for DTC brands between $500K and $50M in annual revenue. Today we’re speaking with Liam Gerada, Co-Founder & CEO of Krepling Pay, a pre-built checkout solution engineered to solve what he calls “the checkout crisis” plaguing mid-market DTC brands.

At 7T, we help companies implement business-first technology that drives measurable outcomes. Checkout optimization sits at the intersection of user experience and revenue performance—making it one of the highest-return initiatives for ecommerce businesses. We wanted to understand how Krepling Pay approaches this critical conversion point and what DTC leaders should be thinking about when evaluating the best ecommerce payment solutions.

Q: Liam, most DTC brands think they’ve optimized checkout if they’ve added express payment options like Apple Pay or Shop Pay. Why isn’t that enough?

A: Express checkout buttons are table stakes today, but they only solve for one type of shopper. The data shows that 60–70% of all ecommerce transactions are still completed via guest checkout—not express options. The problem is that most guest checkout experiences are fundamentally broken: 12–15 form fields spread across three pages, riddled with hidden fees that surprise customers at the end, and often requiring account creation to complete the purchase. When you force a shopper into a multi-step, high-friction process, you’re actively increasing cart abandonment. The best ecommerce payment gateways need to be optimized for both pathways—not just the 30% who use wallets. That’s the gap Krepling Pay fills: a six-field, single-page guest checkout that delivers a 31% increase in checkout conversion and a 44% improvement in checkout speed, while still offering seamless express options without account creation or redirects.

Q: You mentioned six fields versus the typical 12–15. What are you eliminating, and how does that impact cart conversion rate?

A: We eliminate redundancy and friction points that don’t serve the transaction. Traditional checkouts ask for billing and shipping separately, force re-entry of information already captured, and include fields that can be auto-populated or inferred. Krepling Pay uses intelligent field optimization: we consolidate redundant inputs, apply automatic error detection in real time so users correct mistakes before submitting, and pre-fill data wherever possible. This isn’t just about speed—it’s about cognitive load. Every additional field increases the likelihood a shopper will abandon. When you’re competing in DTC categories like health and beauty or fashion and apparel, where customer acquisition costs are climbing, losing a customer at checkout because of a clunky small business checkout system is unacceptable. Our approach to frictionless checkout is built on the principle that the best ecommerce payment solutions comparison should measure actual conversion lift, not just feature lists.

Q: How does Krepling Pay integrate with existing ecommerce stacks, and what does implementation actually look like for a brand doing $2M–$50M annually?

A: We’re platform-agnostic and plug into any tech stack—Magento, WooCommerce, custom builds—without requiring development resources. That’s critical for mid-market DTC brands that don’t have in-house engineering teams or the budget to rebuild their checkout from scratch. Implementation is white-glove and fast: most brands are live within 48 hours to two weeks depending on customization needs. We handle the heavy lifting internally, so brands aren’t pulling dev resources away from other priorities. From a technical standpoint, Krepling Pay is fully white-labeled, meaning your checkout maintains your brand’s look and feel with no redirects. It’s also backed by flat-fee pricing with no hidden costs—which directly addresses one of the biggest pain points we hear: brands are tired of opaque transaction fees eating into margins. For merchants evaluating the best WooCommerce checkout plugin or best ecommerce payment solutions, the decision often comes down to: can you improve conversion and lower processing costs without a six-month integration cycle? That’s where we win.

Q: Guest checkout best practices have evolved significantly. What are brands getting wrong in 2026?

A: The biggest mistake is treating guest checkout as an afterthought. Brands invest heavily in express options but leave their guest flow cluttered and slow. The result is a bifurcated experience where express users get a fast checkout and everyone else gets friction. Another common issue: requiring account creation. We’ve seen this kill conversion in real time. Shoppers don’t want to manage another login, especially on mobile. Krepling Pay allows customers to complete purchases as guests and optionally save payment details via digital wallets for one-click checkout on return visits—without forcing account creation. That’s true guest checkout best practices: give users control and remove barriers. The other piece is transparency. DTC brands are dealing with rising costs—shipping, tariffs, cost of goods—so the last thing you want is to surprise a customer with fees at the final step. A seamless checkout experience means pricing is clear from cart to confirmation, and the process feels intuitive, not like an obstacle course.

Q: You’ve mentioned that Krepling Pay competes against legacy players like Stripe, PayPal, and Shopify’s Shop Pay. How does a newer entrant win in a space dominated by established names?

A: We win by solving a problem the incumbents don’t prioritize: the full checkout experience for non-Shopify merchants. Stripe and PayPal are payment processors first—they offer checkout tools, but those tools require significant development work to optimize. Shop Pay is fast, but it’s Shopify-exclusive and account-dependent. Bolt and other checkout-as-a-service platforms exist, but they’re often expensive and still require heavy technical lift. Krepling Pay is a pre-built, optimized checkout that requires zero dev work, is fully white-labeled, and works across any ecommerce platform. For brands doing $500K–$50M, we’re often the first solution that delivers fast checkout without requiring them to rebuild their stack or compromise on brand experience. The barrier we face is trust—PayPal and Stripe are juggernauts, so brands assume they offer the best ecommerce payment gateway by default. But when we run checkout audits and show brands how much conversion they’re leaving on the table, the decision becomes clear. Our differentiator isn’t just technology—it’s outcomes. We deliver measurable lift in checkout conversion, lower processing costs, and a seamless checkout experience without the complexity.

Ready to eliminate checkout friction and increase conversion? Get your free checkout audit today at pay.krepling.com and see how Krepling Pay can transform your DTC brand’s performance.